Tax-Advantaged Wealth Building for Small Business Owners - Part 2

Part 2: Mastering the Steps: Keys to Successful Tax-Advantaged Accumulation

Welcome back! In this second installment of our three-part series on tax-advantaged accumulation through life insurance, we're diving deeper into the moves that can elevate your wealth-building game. Think of it as a dance routine – each step building on the previous one. So, let's slip on those financial dancing shoes and uncover the keys to a masterful tax-advantaged accumulation performance!

Dance Step 1: Timing Is Everything

Just like a choreographed routine, timing matters. The earlier you start, the more gracefully your wealth can grow. Think of it as perfecting your moves before the big performance. By initiating tax-advantaged accumulation early in your business journey, you're setting the stage for years of tax-efficient growth. The longer your money grooves tax-deferred, the more it can tango its way into substantial gains.

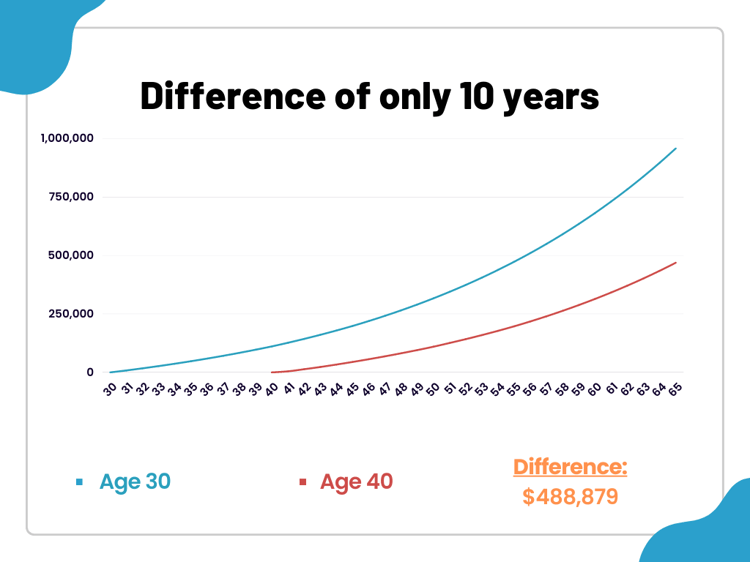

Just look at the image below!! The impact of timing is strikingly evident when comparing two individuals investing in an Indexed Universal Life (IUL) policy. One starts at age 30, while the other begins at age 40. The difference between their financial outcomes is astonishing. The individual who starts at age 30 is projected to accumulate a remarkable $488,879 more than the one who begins at age 40. This substantial sum doesn't even consider the added benefits of the policy's death benefit protection for their loved ones.

Dance Step 2: The Right Partner: Policy Selection

Just as dance partners need compatibility, your choice of life insurance policy matters. Whole life, universal life, and indexed universal life policies each have unique moves. The key is to align the policy with your financial goals. Whole life offers stability, universal life provides flexibility, and indexed universal life adds market-linked potential. It's like selecting the dance style that suits your rhythm.

Dance Step 3: Choreographing Premiums

Every dancer knows their steps, and you need to know your premium contributions. Consistency is key – it's like practicing your routine regularly. The magic happens when your premiums fund your policy's cash value growth. By maintaining steady contributions, you ensure that your financial performance stays in tune with your goals.

Dance Step 4: Crafting Flexibility

In the dance of life, flexibility is paramount. Similarly, your policy's flexibility is a strategic advantage. As a small business owner, your financial journey can take unexpected turns. Accessing your cash value during financial twists and turns can keep you on the rhythm of success.

Dance Step 5: Professional Choreography

Just as a dance troupe needs a choreographer, your tax-advantaged accumulation journey requires professional guidance. Financial advisors and insurance experts are your dance instructors, helping you master the steps with finesse. They tailor the strategy to your unique circumstances and ensure your performance shines bright.

Nailing the Moves for Financial Success

You've learned some of the most crucial dance moves in the world of tax-advantaged accumulation. Timing, policy selection, premium consistency, flexibility, and expert guidance – these steps form the core of your wealth-building routine. You're not just dancing with finances; you're orchestrating a symphony of success. Get ready for the grand finale in Part-3, where we'll wrap up our series with finesse and flair.

Stay tuned for the third and final part where we'll unveil advanced strategies and bring your tax-advantaged accumulation performance to a stunning close!

Ready to give your loved ones and business the gift of lasting security? Don't hesitate—seize the moment and pave the way for their future with the perfect life insurance coverage.

At Kovach Consulting Group, we offer you two paths:

Already know what you need? Skip the small talk and grab a quote without the agent chit-chat.

Prefer expert guidance on your journey to peace of mind?

Our savvy team is at your service, ready to demystify the process and assist your decision-making. Connect with us now for a personalized quote and let the adventure begin!

Keep in mind, spots are precious! Due to overwhelming demand, we're only accepting 10 new clients each week. Reserve your spot before they're all snapped up.