Mastering the Transition: Converting Term to Permanent Life Insurance for Financial Success

Published by John Kovach on

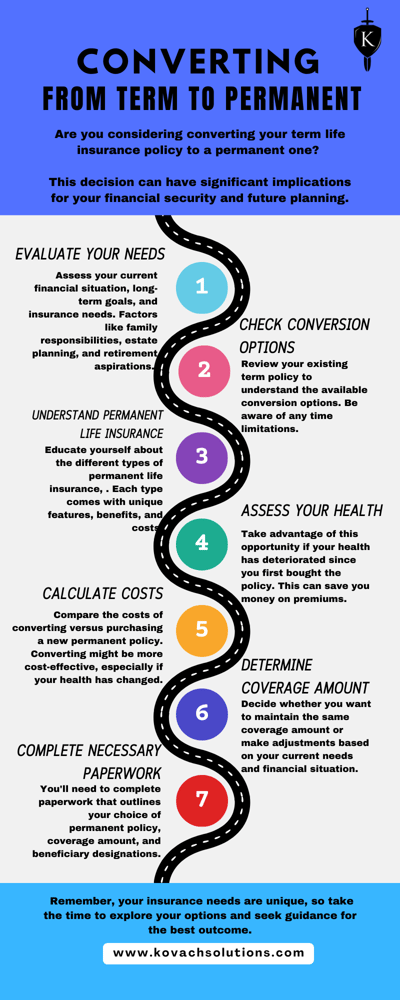

Are you considering converting your term life insurance policy to a permanent one? This decision can have significant implications for your financial security and future planning. In this guide, we'll walk you through the process, providing valuable tips, tricks, and important steps to ensure a smooth transition. Plus, we'll highlight five common pitfalls to avoid when converting term to permanent life insurance.

Understanding the Need for Conversion:

Term life insurance offers coverage for a specified period, usually 10, 20, or 30 years. As the term nears its end, you might find that your insurance needs have evolved. Converting to permanent life insurance can provide lifelong coverage, build cash value, and offer additional benefits. Here's how you can navigate this transition effectively:

Step 1: Evaluate Your Needs

Assess your current financial situation, long-term goals, and insurance needs. Consider factors like family responsibilities, estate planning, and retirement aspirations. This evaluation will guide your decision on the type of permanent life insurance that suits you best.

Step 2: Check Conversion Options

Review your existing term policy to understand the available conversion options. Some policies may offer a conversion window during which you can convert without a medical exam. Be aware of any time limitations.

Step 3: Understand Permanent Life Insurance

Educate yourself about the different types of permanent life insurance, such as whole life, universal life, and indexed universal life. Each type comes with unique features, benefits, and costs.

Step 4: Assess Your Health

If your term policy allows conversion without a medical exam, take advantage of this opportunity if your health has deteriorated since you first bought the policy. This can save you money on premiums.

Step 5: Calculate Costs

Compare the costs of converting versus purchasing a new permanent policy. Converting might be more cost-effective, especially if your health has changed. However, be sure to factor in any conversion fees.

Step 6: Determine Coverage Amount

Decide whether you want to maintain the same coverage amount or make adjustments based on your current needs and financial situation.

Step 7: Complete Necessary Paperwork

Contact us to initiate the conversion process., we can do a policy review with you to outline your options if necessary. You'll need to complete paperwork that outlines your choice of permanent policy, coverage amount, and beneficiary designations.

Tips and Tricks for a Smooth Conversion:

- Start the process early to allow ample time for evaluation and decision-making.

- Consult with Kovach Cosulting Group to ensure your choice aligns with your goals.

- Compare quotes from different insurance companies to get the best rates for your new permanent policy.

Common Pitfalls to Avoid:

1. Waiting Too Long: Converting close to the end of your term might lead to higher premiums due to age-related factors.

2. Not Exploring Options: Failing to research various permanent policies could result in missed opportunities for better coverage or benefits.

3. Overlooking Costs: Converting without comparing costs to purchasing a new policy could lead to unnecessary expenses.

4. Ignoring Health Changes: If your health has deteriorated, failing to take advantage of conversion without a medical exam might cost you in higher premiums.

5. Skipping Professional Advice: Not consulting an insurance professional might lead to sub-optimal choices for your unique situation.

Converting term to permanent life insurance is a strategic move that requires careful consideration. By understanding the process, following essential steps, and avoiding common pitfalls, you can make an informed decision that aligns with your financial goals and provides long-term security for you and your loved ones. Remember, your insurance needs are unique, so take the time to explore your options and seek expert help for the best outcome.

Understanding the Need for Conversion:

Term life insurance offers coverage for a specified period, usually 10, 20, or 30 years. As the term nears its end, you might find that your insurance needs have evolved. Converting to permanent life insurance can provide lifelong coverage, build cash value, and offer additional benefits. Here's how you can navigate this transition effectively:

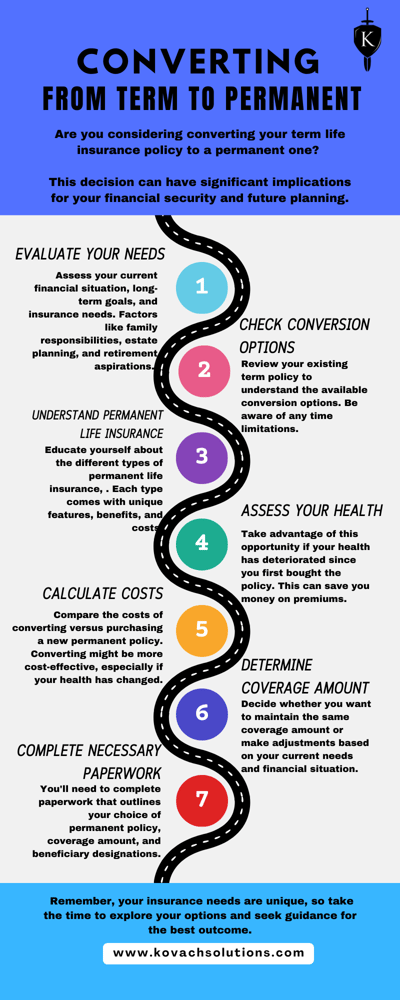

Step 1: Evaluate Your Needs

Assess your current financial situation, long-term goals, and insurance needs. Consider factors like family responsibilities, estate planning, and retirement aspirations. This evaluation will guide your decision on the type of permanent life insurance that suits you best.

Step 2: Check Conversion Options

Review your existing term policy to understand the available conversion options. Some policies may offer a conversion window during which you can convert without a medical exam. Be aware of any time limitations.

Step 3: Understand Permanent Life Insurance

Educate yourself about the different types of permanent life insurance, such as whole life, universal life, and indexed universal life. Each type comes with unique features, benefits, and costs.

Step 4: Assess Your Health

If your term policy allows conversion without a medical exam, take advantage of this opportunity if your health has deteriorated since you first bought the policy. This can save you money on premiums.

Step 5: Calculate Costs

Compare the costs of converting versus purchasing a new permanent policy. Converting might be more cost-effective, especially if your health has changed. However, be sure to factor in any conversion fees.

Step 6: Determine Coverage Amount

Decide whether you want to maintain the same coverage amount or make adjustments based on your current needs and financial situation.

Step 7: Complete Necessary Paperwork

Contact us to initiate the conversion process., we can do a policy review with you to outline your options if necessary. You'll need to complete paperwork that outlines your choice of permanent policy, coverage amount, and beneficiary designations.

Tips and Tricks for a Smooth Conversion:

- Start the process early to allow ample time for evaluation and decision-making.

- Consult with Kovach Cosulting Group to ensure your choice aligns with your goals.

- Compare quotes from different insurance companies to get the best rates for your new permanent policy.

Common Pitfalls to Avoid:

1. Waiting Too Long: Converting close to the end of your term might lead to higher premiums due to age-related factors.

2. Not Exploring Options: Failing to research various permanent policies could result in missed opportunities for better coverage or benefits.

3. Overlooking Costs: Converting without comparing costs to purchasing a new policy could lead to unnecessary expenses.

4. Ignoring Health Changes: If your health has deteriorated, failing to take advantage of conversion without a medical exam might cost you in higher premiums.

5. Skipping Professional Advice: Not consulting an insurance professional might lead to sub-optimal choices for your unique situation.

Converting term to permanent life insurance is a strategic move that requires careful consideration. By understanding the process, following essential steps, and avoiding common pitfalls, you can make an informed decision that aligns with your financial goals and provides long-term security for you and your loved ones. Remember, your insurance needs are unique, so take the time to explore your options and seek expert help for the best outcome.

Ready to give your loved ones the gift of lasting security? Don't hesitate—seize the moment and pave the way for their future with the perfect life insurance coverage.

At Kovach Consulting Group, we offer you two paths:

If you already know what you need? Skip the small talk and grab a quote without agent chit-chat.

Prefer expert guidance on your journey to peace of mind? Our savvy team is at your service, ready to demystify the process and assist your decision-making. Connect with us now for a personalized quote and let the adventure begin!

Keep in mind, spots are precious! Due to overwhelming demand, we're only accepting 10 new clients each week. Reserve your spot for a chat before they're all snapped up.