Tax-Advantaged Wealth Building for perceptive Small Business Owners - Part 1

Part 1: The Smart Entrepreneur's Guide to Tax-Advantaged Accumulation

In this three-part series, we're diving into the world of tax-advantaged accumulation through life insurance – a strategy tailor-made for the sharp minds behind small businesses.

Introduction: The Tax Tango of Wealth Building

Running a small business is like choreographing a complex dance – and taxes are your ever-present partner. But what if we told you there's a way to tango with taxes on your terms? That's where tax-advantaged accumulation through life insurance waltzes in. It's not just a strategy; it's a symphony of savvy financial moves that can make your wealth grow while tax worries take a backseat.

Dance Move 1: The Cash-Value Waltz

Enter the life insurance stage, where cash-value policies steal the spotlight. Imagine it as a two-in-one deal: insurance coverage with an investment twist. Your premiums pull double duty, nurturing a cash value that grows over time. But here's the catchy part – this growth is tax-deferred. That means your money gets to boogie without tax worries dampening the groove.

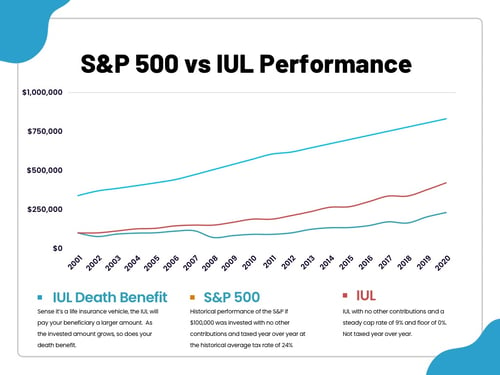

Tax Efficiency Up Close: Imagine investing $10,000 annually in a taxable account with an 8% annual return. After 20 years, your gains could be around $348,000. But with tax-advantaged accumulation, you could pocket an impressive $424,000! That's a sweet tax-saving encore worth dancing about.

Dance Move 2: The Tax-Free Tango

Now, here's the head-turner – those tax-deferred gains can be withdrawn tax-free. Yes, you heard right – tax-free. When you tap into your cash value, it's more like dipping into a fountain of financial freedom. Whether it's a dream vacation, funding a side project, or simply dancing to your heart's content, those withdrawals won't ring the taxman's bell.

Dance Move 3: Estate Planning Rumba

Ah, the timeless art of leaving a legacy. Small business owners, you've nurtured your ventures with love – now extend that legacy to your loved ones. When you waltz into the great beyond, your beneficiaries can receive the death benefit tax-free. It's a graceful rumba of financial security that ensures your legacy thrives without the weight of estate taxes.

Strut to Success with Tax-Advantaged Accumulation

You've mastered the art of innovation, resilience, and now – tax-advantaged accumulation! This first part of our series is just the opening act, setting the stage for you to shine. You're not just building wealth; you're orchestrating a financial symphony that's as harmonious as it is rewarding. So keep those dancing shoes on – the next part awaits with more financial finesse and witty wisdom.

*Stay tuned for Part 2 where we'll unveil the keys to successful tax-advantaged accumulation – because who said taxes can't groove to your tune?

Ready to give your loved ones and business the gift of lasting security? Don't hesitate—seize the moment and pave the way for their future with the perfect life insurance coverage.

At Kovach Consulting Group, we offer you two paths:

Already know what you need? Skip the small talk and grab a quote without the agent chit-chat.

Prefer expert guidance on your journey to peace of mind?

Our savvy team is at your service, ready to demystify the process and assist your decision-making. Connect with us now for a personalized quote and let the adventure begin!

Keep in mind, spots are precious! Due to overwhelming demand, we're only accepting 10 new clients each week. Reserve your spot before they're all snapped up.